..

Myanmar Energy Sector Assessment, Strategy, and Road Map

This sector assessment, strategy, and road map

documents the Asian Development Bank’s (ADB) current assessment and

strategic investment priorities of the Government of Myanmar in the...

...

Myanmar’s Energy Sector: An Overview

by Alissa Nicole Thompson

Abstract

Myanmar

is straddling a new national development plan. Since the new civilian

government took office in 2011, reforms were necessary after the changes

resulting from the sanctions previously imposed on the country. Energy

will undoubtedly play a role Myanmar’s growth, and the country is

expected to receive significant amounts of foreign direct investment to

jumpstart the economy. Using energy as a strategy to emerge from

isolation, Myanmar is striving to take advantage of new technologies and

foreign investments, in order to reach its developmental goals under

the new government. This paper looks at plans for improving living

standards by promoting the wider use of renewables, increasing energy

efficiency and conservation, and promoting the use of alternative fuels

in household use to meet energy demand predictions. The findings of the

various implemented measures show stagnation. The paper concludes that

the government must first make internal adjustments to enable effective

policies and achieve their goals.

Key words: Myanmar; economic development; biomass; renewable energy; solar; hydro; wind.

Myanmar, after a static

period of isolation and with sanctions in place since the late 1980ies,

is undergoing a serious transition. The country’s new civilian

government took office in March 2011 with a goal of integrating into the

modern world through economic development. The new national development

plan has a goal to implement positive changes.

However, this comes with

no easy formula. In 2012, Myanmar was ranked 161 out of 180 in the

International Monetary Fund’s listing of the poorest countries, and was

ranked 149 out of 187 in the United Nation’s Human Development Index.[1] This reflects the poor standard of living amongst the population of 53 million, the fifth most populous country in ASEAN.

As a result, we find a

country trying to overcome their domestic energy deficiency while taking

advantage of foreign investment, the majority of which is funneled to

the energy sector.

Myanmar’s Energy: Assets and Challenges

Considered by many to be

the ‘last frontier’, Myanmar has great potential to develop into a

relatively important country within the region. From its reputation as a

pariah state through Ne Win, the country isolated itself from

energy-intensive globalization, as the outside world was withdrawn from

access due to U.S.-led sanctions, giving way to a xenophobic government

that formed a special friendship with China due to their mutual offenses

during the violence of protests in Myanmar and the Tian’anmen Square

protests a year later.

Today, under Thein Sein’s

leadership, seen as a transitioning bridge between the military and

civilian government, the country has regained a certain degree of

respectability amongst its neighbours, evident during the 2014 ASEAN

Regional Forum in Nay Pyi Taw, as well as with the United States, when

in 2011, Hillary Clinton become the first U.S. Secretary of State to

visit in over 50 years, and in 2012, Barack Obama became the first

sitting president to visit Myanmar. Likewise, Thein Sein was received in

Washing- ton, D.C., the following year.

Additionally, this

reformation period is seen in Myanmar’s foreign relations. Even though

the Shwe project, exporting Myanmar oil and gas to China, was completed,

China cut direct investments in the country by 90% from 2011 to 2012.[2]

The renewed interest in Myanmar was evident in the U.S., when Derek

Mitchell became the first U.S. appointed ambassador to Myanmar in over

20 years. This has lead from previous loophole sanctions in the energy

sector, enabling international companies such as Chevron and Total to

continue business, in addition to regional companies such as PTTEP,

Petronas and Daewoo to have dominance in the field, to total legitimate

development, opening a portal of opportunity for foreign investments.

Myanmar understands energy will be an inevitable element of the

expansion of their economy.

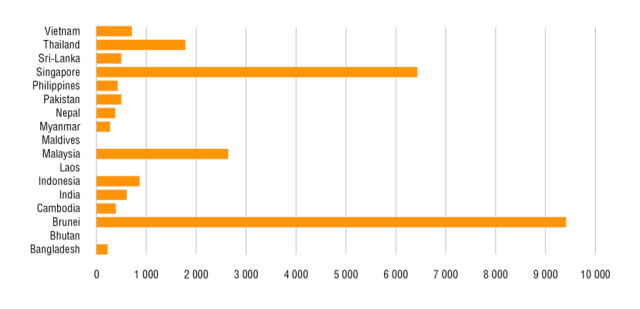

Figure 1. Energy use (2011)

Source: World Bank.

Figure 2. Energy use (2011, kg of oil equivalent per capita)

Source: World Bank.

The exploitation of natural resource deposits are

the cornerstone of development of Myanmar. The official estimates are

humble, at 50 million barrels of oil and 8 billion cubic meters (bcm),

according to the Economist.[3]

Nevertheless, it is the unofficial estimates and great potential

for

new reserve discoveries that secure new investments.

In terms of energy consumption,

Myanmar is a relatively small player – comparable with Sri Lanka, Nepal

and Bangladesh (Figure 1). Per capita energy use in Myanmar is lower

than Sri Lanka, Nepal, Cambodia, Philippines, and is comparable with

Bangladesh (Figure 2). Myanmar especially appears underdeveloped in

terms of energy use and energy access in comparison with Thailand and

Indonesia – its two neighbours, who together consume 58% of ASEAN’s

energy.

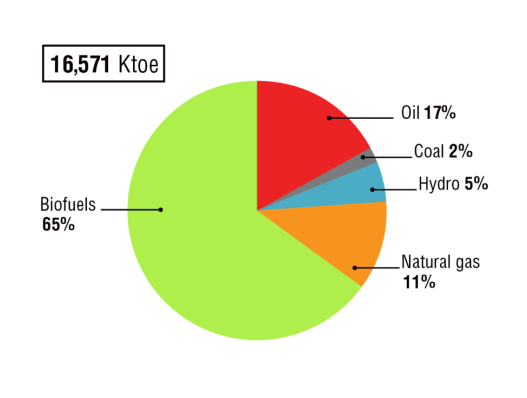

Myanmar’s total primary energy mix,

according to the IEA

in 2013 (Figure 3), presents a rudimentary image.

The majority at 65.3% is from traditional biofuels and waste; 90% of

this is fuel wood, an issue that promotes deforestation and continued

illegal timber trade. This is a very high share, especially in

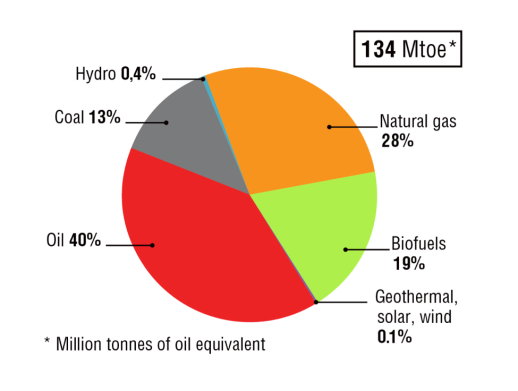

comparison with both Thailand’s and Indonesia’s share of biofuels and

waste in their fuel mixes. The oil share comes in second at 16.8% of

total primary energy mix. Domestically produced natural gas contributes

to a 11.1% share in the fuel mix. Much of this is transformed into

electricity, of which 60% goes to gasfired power plants, specifically

towards the industry, transport, and chemical/petrochemical sectors (12%

for fertilizer production). Hydropower is modest at 4.6%, contributing

2,520 MW. This is a particular feature of Myanmar’s natural renewable

energy availability, as both Thailand and Indonesia have very low shares

of hydro. The least of all

the shares is coal at 2.2%. Myanmar

typically uses lignite and other bituminous coal for electricity

generation and the industry sector.

Exports and imports of energy resources. Myanmar

imports refined sources such as motor gasoline, jet kerosene and diesel

to be consumed within the industry, transport,

and agricultural

sectors.

The majority of Myanmar’s

natural gas is exported, Myanmar has been providing natural gas to

Thailand since 1998 from the Yadana gas field, eventually expanding

to

the Yetagun gas field in 2000, then the Zawtika gas field that commenced

production in 2014. This natural gas, which is the 2nd largest share after oil, accounts for 53% of the 28.4% of Thailand’s share of total primary energy supplies in 2013.[4]

Figure 3. 2013 Myanmar total primary energy mix

Source: IEA.

Figure 4. 2013 Thailand total primary energy mix

Source: IEA.

Figure 5. 2013 Indonesia total primary energy mix

Source: IEA.

Overall, there is a great need to (1) improve the

domestic energy mix and (2) develop the infrastructure. The energy grid

concentrated in urban areas allowed 26% of the population connection and

is unbeneficial to the 70% living in rural areas, where average

electrification rates are 16%.

Current Energy Initiatives

Energy is a significant element within Myanmar’s

national development plan. The interest of fulfilling their energy

potential both locally and in trade is in line with in Myanmar’s new

energy policy goals.[5]

The new civilian government, motivated by potential of the energy

sector to become a catalyst for Myanmar’s economy expansion, finally

integrated the nation’s energy sub-sectors under one umbrella. In doing

so, they have formed new committees for the main purpose of increasing

coordination: the National Energy Management Committee (NEMC) is tasked

to formulate energy policies and arranges cooperation between energy

ministers, while the Energy Development Committee (EDC) will implement

these policies.

The overall goals of Myanmar’s energy policy, according to the Asian Development Bank’s Initial Energy Sector Assessment,[6] center on:

- Maintaining energy independence;

- Promoting wider use of renewable sources of energy;

- Promoting household use of alternative fuels;

- Promoting energy efficiency and conservation.

It seems that the ultimate goal of maintaining energy

independence is to be achieved through the aforementioned three

supportive goals. This is the basis of the structuring of this section,

where the goals of Myanmar’s energy policy will be evaluated in the

current measures the government is implementing to achieve these goals,

to lead to the overall concluding goal of whether maintaining energy

independence is feasible.

Promoting wider use of renewables. Renewable

sources

of energy are currently key in two dimensions of Myanmar’s

energy system: their role in electricity generation (and improvement of

access to electricity), as well as in direct final use. Direct final use

is a massive segment – wood

and waste are used in the residential

sector for heating and cooking. Consumption of primary solid biofuels,

based on gross calorific value, is close to the volume of natural gas

production of the country (453107 versus 483794 TJ respectively). This

segment will be discussed in the next section, while here I will focus

on the power generation sector.

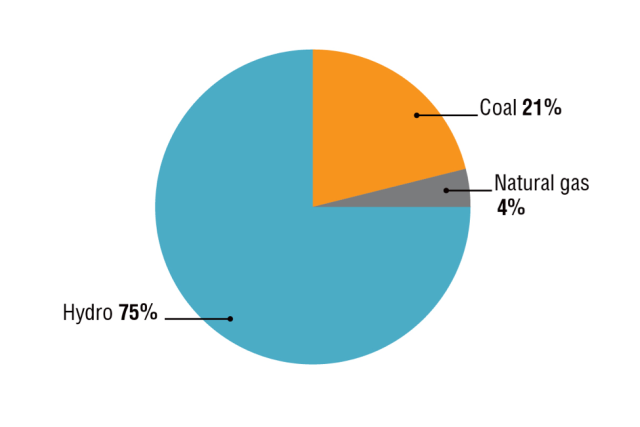

Myanmar’s current level of electricity production,

according to the IEA statistics, is at 11,890 GWh, and 8878 GWh is

provided by the hydropower sector. On the one hand, renewable energy (in

the form of hydro) is a major share pf electricity generation mix

(Figure 6); on the other, it is the only renewable energy source that is

actually used in the country’s electricity generation (Table 1).

Figure 6. Myanmar electricity production

Source: International Energy Agency, (2013), Myanmar: Electricity and Heat for 2013. Available at: https://www.iea.org/statistics/statistics-search/report/?year=2013&country=Myanmar&product=ElectricityandHeat [Accessed 1 December 2015].

Gross electricity generation (GWh)

|

|

Municipal waste

|

0

|

Industrial waste

|

0

|

Primary solid biofuels

|

0

|

Biogases

|

0

|

Liquid biofuels

|

0

|

Geothermal

|

0

|

Solar thermal

|

0

|

Hydro

|

8878

|

Solar PV

|

0

|

Tide, wave, ocean

|

0

|

Wind

|

0

|

Table 1. Electricity generation in Myanmar from renewable energy sources, 2013, GWh

Source: International Energy Agency, (2013). Myanmar: Renewables and Waste for 2013. [online] Available at: https://www.iea.org/statistics/statisticssearch/report/?year=2013&country=Myanmar&product=RenewablesandWaste [Accessed 1 December 2015].

Overall, to ensure

sustainable and environmentally clean energy development in the long

term, Myanmar seems

to be focusing on long-term growth through the

usage

of renewable sources of energy, rather than short-term

electrification through hydrocarbon resources. Myanmar possesses the

resources to develop renewables, such as hydro, tidal, wind and solar,

making renewables in general a feasible option for the development of

the energy system.

Renewables, among other things, can assist in

solving

a problem of access to electricity and electrification.

Currently, for local consumers, connections to energy grids nationwide

start at 595 USD, leaving many villages without access to electricity.[7] To counter purchasing connections, renewables can be used within the small-scale systems (‘distributed generation’).

Hydropower is a

major source of energy for Myanmar, but there are two major factors

impeding its expansion. Firstly, during the dry season, the amount of

hydropower generated decreases drastically. As it is unpredictable,

sometimes it is reduced to nothing. Secondly, hydropower projects are

unpopular nationwide due to the forced relocation of villagers, as well

as the environmental degradation it could bring through erosion and

unnatural flooding of previously dry areas.

A viable source of energy in Myanmar is tidal energy

in

coastal areas: the tide rises and falls twice a day,

and powerful water

currents reaching up to eight knots. The schedule of the tides is

reliable and predictable.

Another type of renewable energy that follows from Myanmar’s large coastal areas is wind energy.

With a coastal strip of 2,832 kilometres and southwesterly wind for

nine months and northeasterly wind for three months available, the wind

energy in Myanmar has a potential of 365 terra-watt hours (TWH) per

year.[8]

Three areas stand out as promising for wind harnessing: the regions of

Chin and Shan states, southern and western coastal regions, and central

Myanmar.

Solar power is at

early stages of its development in Myanmar as well. Solar power within

Myanmar has a poten

tial of providing 51,973 TWH per year.[9]

At the moment, solar power is harnessed through photovoltaic cells used

for battery-charging stations and water pumping for irrigation. One

challenge solar development faces is the lack of trust for this

technology by villagers, due to the prevalence of low-quality solar

products, which has led to poor experience. Currently solar stand-alone

systems have been installed at more than 200 places nationwide.

Project

|

Capacity

|

Companies involved

|

Notes

|

Chaung Thar Hybrid Power Supply System Project

|

Includes 40 kW wind power system

|

Japan’s Fuji Heavy Industries Ltd

|

Hybrid system

· Street lighting for a safer environment

· Night lighting to increase productivity of the village

· Clinic lighting to allow more power for medical equipment usage and vaccine refrigeration

|

Wind power plant in Mon State

|

32 MW

|

Zeya & Associates Co., Ltd., Vestas Wind Systems

|

Wind system

|

Magway region

|

Up to 220 MW

|

Black & Veatch

|

Solar system

Will supply electricity for local communities and

industry, and the construction is scheduled to start in 2016.

Southeast’s Asia’s largest solar power plant

|

Table 2. Summary of selected renewable energy projects in Myanmar

Source: Asia Biomass Office, 2015. Current Status of Wind Power in Myanmar. [online] Available at: https://www.asiabiomass.jp/english/topics/1509_05.html [Accessed

1 December 2015]; Zeya & Associates, 2015. ZEYA & ASSOCIATES

SIGNS MOU WITH VESTAS

FOR COLLABORATION ON WIND POWER PROJECTS IN

MYANMAR [online]

Available at: http://www.rgkzna.com/content/zeya-associates-signs-mou-vestas-collaboration-wind-power-projects-myanmar [Accessed

1 December 2015]; Black & Veatch, 2015. Black & Veatch starts

work in Myanmar on Southeast Asia’s largest solar power plant [online]

13 October. Available at: http://bv.com/home/news/news-releases/black-veatch-starts-work-in-myanmar-on-southeast-asias-largest-solar-power-plant [Accessed 21 December 2015].

The Ministry of Science and Technology’s research

and development department has also been designing hybrid renewable systems with capacities around 30 kW based on biogas and solar energy.

The commercial potential of both wind and solar is

overall underutilized, but the current implementation of these sources

is usually catered towards areas without access to the national grid.

The summary of the projects is provided in the table below (Table 2).

A mere 30% of the population has access to

electricity, leading to the country being the lowest amongst ASEAN

in

terms of per capita electricity consumption. This is all

a result of

inadequate maintenance of generation capacity, the lack of investment to

upgrade gas and coal power plants. This means a significantly lowered

potential capacity. Even in urban areas blackouts are frequent and a

common occurrence; In Yangon, 60% have access to electricity.

Promoting household use of alternative fuels. In

implementing the policy of wider use of renewables, promoting household

use of alternative fuels should be considered a consequential task.

This section will provide the details of alternative fuel potential,

specifically the development of modern biomass in Myanmar, both for

household and industrial usage.

The population in rural areas relies on off-grid

sources such as fuel wood (or ‘traditional biomass’) and kerosene. The

Ministry of Agriculture and Irrigation is considering substituting

gasoline and diesel consumption with modern biofuels; gasoline is to be

substituted by bio-ethanol, and diesel is to be substituted by

diesel-blends and bio-diesel. In doing so, the possibility of biofuels

competing with food production needs to be evaluated. To counter this,

the government has claimed almost six million hectares can be used for

biofuel crops without displacing 11 million hectares dedicated to food

and industrial crops. Although this seems harmless, it also means the

5.9 million hectares of uncultivated land will be deforested in order to

grow fuel crops.[10]

Apparently, the production of biofuels will ensure rural energy

security, which is true, and create jobs, since rural-to-urban migration

is expected, as jobs move from the agricultural sector to services.

Various feedstocks are being considered – the potential biomass energy

sources is summarized below (Table 4).

Project

|

||||

Bio-ethanol

|

Sugarcane, maize, cassava, sorghum, sweet sorghum, potato, toddy palm, nipa palm, root crops.

Since 2002, the Myanmar Chemical Engineer’s Group

constructed four ethanol plants to produce 7.4 million liters annually.

In 2008, the Myanmar Economic Cooperation built two ethanol plants,

adding a capacity of 6.8 million liters annually. Beyond the public

sector, private companies such as Great Wall have constructed two

ethanol plants, based on sugarcane and cassava.

|

|||

Bio-diesel

|

Palm oil, rapeseed, jatropha, coconut, niger, neem seed, cotton seed, soy bean, sesame, peanuts

|

|||

Gasification

|

Rice husk, sawdust, waste of forest products, agricultural waste, urban waste

|

|||

Biogas

|

Livestock wastes

|

Table 3. Myanmar’s potential biomass energy sources

Source: Ministry of Agriculture and Irrigation.

Since 1986 a compressed natural gas and natural gas

vehicle program was implemented. By 2011, 27,000 buses and cars were

converted.[11]

The number looks impressive, yet once compared to the 356,580

registered passenger and commercial vehicles in the country in 2011

(summing up the number of cars and 4-wheeled light vehicles, buses, and

trucks),[12]

this is merely 7.6%. Furthermore, the past government’s Jatropha

Plantation Project in 2006 to pro- duce 40,000 daily barrels of

bio-diesel to replace oil imports failed, as costs were too high and

yields were too low.[13]

Nevertheless, it seems the failure is to be blamed on dependent

variables such as weak implementation, that can be improved in the

future through better planning and cooperation, rather than independent

variables, allowing

a positive outlook to remain on other biomass

potential.

In addition, due to the strong, already existing

agricultural sector within the nation, modern biomass has the greatest

commercial prospects.

In addition to energy crops, other sources can be

produced into biomass, such as agricultural waste, industrial waste,

livestock waste, and municipal solid waste. Biogas has multiple uses

that make it attractive to develop, including cooking, lighting,

preservation of grains, preparation of fodder, and driving internal

combustion engines. This essentially constitutes the energy needs of a

household.

Biomass usage in villages is implemented through

biogas plants and biomass gasifiers. An example can be demonstrated by

the 33 million tons of rice Myanmar produces annually. The rice mills

that function continuously all year excrete large amounts of rice husks

that can then be used to generate steam for steam engines, or in motors

or diesel engines.

In fact, Wuxi Teneng Power Machinery Co., Ltd.,

installed a 1000 Kw biomass gasification power plant using rice husk in

2014, at one of Myanmar’s largest rice mills.

On the household aspect, a

village-scaled rice husk gasifierenginegenerator system with 50 kW

capacity was constructed in Dagoon Daing village, distributing

electricity to 304 houses in the population of 1,496 people.

Subsequently, a similar model has been developed for the utilization of

rice husk by Indigo Energy (Figure 7), “a company dedicated to improving

the reliability of electricity in Myanmar and the three quarters of the

country who do not have it.”[14]

Figure 7. System if using Rice husk in the process of energy production

Source: Indigo Energy, 2015. Our Company. Available at: http://www.indigoenergy.net/our-company/ [Accessed 22 December 2015].

However, construction of this model has yet to be

completed. In 2012, the U.S. company, Viaspace signed an agreement with

the government to bring King Grass to Myanmar. King Grass is a high

yield biomass clean energy crop and low-carbon fuel, enabling it to

supply clean electricity generation. In 2013, an update stated King

Grass was growing well locally and two projects were being worked on: an

1 MW anaerobic digestion power plant to serve as a nationwide model for

rural areas, and a larger direct combustion power plant to be connected

to the national grid or to provide electricity for industrial purposes.

In 2013, a joint project between the Asian wing of Nation First

Economic Development and Myanmar’s Hisham Koh & Associates was

signed to develop algae farms within the country. Algae can be produced

for biofuel or commercial animal feeds, making it a worthwhile

investment.

The fact that statistics are hard to find in these

new development projects reveal that modern biomass production in

Myanmar is still in a preliminary stage, perhaps even at a discouraging

sight, as the initially hopeful projects seem to have stagnated in their

updates. Another element to be blamed is the fact that a national

biofuel plan with clear targets and a road map for their achievement has

not yet been properly designed.

Energy Efficiency and Conservation.

According to the Asian Development Bank, the lack of energy efficiency

in Myanmar is a result of the lack of a legal and regulatory frame-

work, also there are no institutions dealing with the issue of energy

efficiency.

Improvements are being made locally. Some sporadic examples include:[15]

- New building codes and standards to improve energy use by buildings in Yangon (Yangon Master Plan with the Japan International Cooperation Agency’s assistance);

- The use of PE-coated pipelines to supply Yangon’s power plants and gasfired factories (improved longevity of these pipelines of at least 15 years, as there is better protection against rust);

- Improvement of coalfired power plants’ efficiency to above 40% (the use of ultra supercritical boiler technology imported from Indonesia, which promises very high efficiency levels and lower emissions).

Nevertheless, not one sector has overall

responsibility regarding energy efficiency, and as a result, there is

very limited progress. For example, there is no analogue of Thailand’s

Department of Alternative Energy Development and Efficiency, which is

within the Ministry of Energy.

Energy should be recognized as a scarce and valuable

resource. This will transform the culture of energy conservation.

Overall, there is great need for energy efficiency regulation and proper

rehabilitation of existing facilities.

Conclusion: The Path Forward

Through observing Myanmar’s energy policy goals and

measures, we can deduct that hydropower and biomass energy is seen as

the government plan’s core potential power source, whilst solar power

and wind energy has less aspirations due to its unreliability and, as of

now, poor commercial aspects and short-term factors. As a result,

Myanmar has shifted towards trying to control household energy

consumption through promoting alternative fuels as the primary source of

civilian energy resource to reduce any substantial growth and cost in

energy imports, reducing energy dependency.

The government’s ultimate goal of maintaining energy

independence can be rationalized by xenophobic tendencies, and to avoid

any devastating consequences of possible external pressures. In

addition, perhaps it is meant to avoid the “resource curse” and the

potential in becoming a “petrostate.” In both these matters, there

appears to be a popular idea to prevent the population’s dependence on

foreign fuel imports, as well as on their own hydrocarbon resources.

This could be rationalized in another perspective for the sake of

economic purposes, as the government hopes to maximize the profit of

selling their natural resources, instead of using it domestically, in

turn opting for using

the initial revenues towards existing alternative

fuels aspirations, and newer renewable resources development

to satisfy

their local energy consumption.

However, the expansion of Myanmar’s economy also

means that citizens are going to start earning more and consuming more,

increasing the amount of energy consumption per capita. In regards to

their overall progress so far, alternative resources and fuels cannot

meet these needs. Myanmar will confront many hindrances to achieving

their energy policy goals. The country lacks human and technological

capacity. The institutional foundation is not strong enough to lead to

reasonably consistent cooperation for reliable results. This means the

ultimate goal of maintaining energy independence will not to be achieved

until these improvements are made; perhaps for some time to come, as

although democratic hope is brimming due to Aung San Suu Kyi’s National

League for Democracy party, even the installation of a democratic

civilian government

is not a precursor of miraculous development.

Realistically, we are looking at a change that will only begin to show

after at least ten years.

For now, the government should focus on removing

these barriers while at the same time, focus on construction

and

maintenance of local gas pipeline infrastructure. This contradicts the

idea of focusing on long-term growth, rather than shortterm

electrification through hydrocarbons; however, it is a likelier source

to satisfy the predicted increase in local energy needs, to make sure it

can deliver consistent amounts with high efficiency, as renewables

development in the country does not yet have the means to prosper and be

fully implemented, since many of these projects are still in research

and development stages.

REf:https://enerpojournal.com/2016/06/24/myanmars-energy-sector-an-overview/

No comments:

Post a Comment